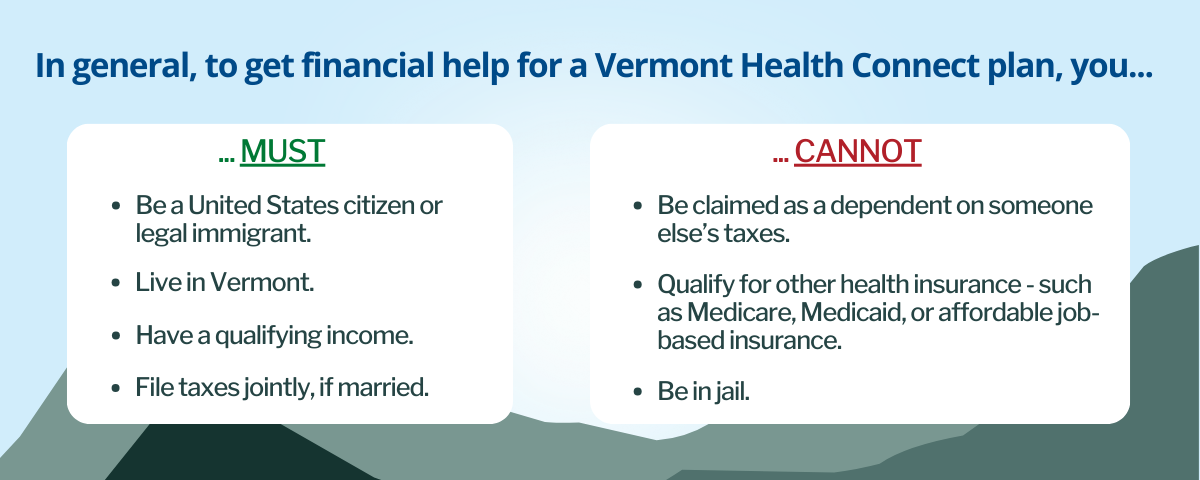

Eligible Vermonters can get help paying for a qualified health plan. To get financial help, you must enroll through Vermont Health Connect plan. You can enroll in any qualified health plan in the marketplace – bronze, silver, gold, or platinum. If eligible, you can apply premium tax credits to the plan of your choice.

If you enroll directly with your insurance company, you can’t get financial help (even if you have a qualifying income). However, there are two ways you or your family members could get a qualified health plan.

- Eligible direct enrolled customers can transfer their plan to Vermont Health Connect at any time.

- Families with offers of employer-sponsored health coverage may have new opportunities for savings, even if they were not eligible before. Use the Affordable Employer Coverage Tool to check whether the employer-sponsored coverage is considered "affordable" by federal standards.

Want to know which plan will best meet your needs? Do you qualify for financial help? Check out the Plan Comparison Tool to get an estimate.

If you enroll in a qualified health plan through Vermont Health Connect, there are three basic types of help you can get, if you qualify:

- Advance premium tax credits (APTC). This is a program that helps lower your monthly premium. It's based on your federal income taxes. Many people take this tax credit each month to lower their health insurance premiums. Your household's APTC amount is calculated based on the applicable percentage of your income. OR you can take the tax credit when you file your federal tax return. Learn more about premium tax credits.

- The applicable percentage is the portion of a subsidy-eligible household's income that can be spent on the marketplace's benchmark plan (second lowest-cost Silver plan).

- Cost-Sharing Reductions reduce your out-of-pocket costs. This program is only available with silver health plans, also called Enhanced Silver plans. These plans are designed to reduce your medical costs by lowering deductibles, co-pays and max-out-of-pocket limits. This means your insurance company covers more of your medical costs, and you pay less. Based on your income, you can get one of four Enhanced Silver plan levels: Enhanced Silver 73, Enhanced Silver 77, Enhanced Silver 87 and Enhanced Silver 94. The number next to the plan name tells you the percent of your medical costs the plan will cover, on average.

- Vermont Premium Assistance (VPA) is money from the State of Vermont that lowers your monthly health insurance bill. Your household's VPA amount is calculated based on the applicable percentage of your income. The State sends your VPA to your insurance company for you. VPA lowers your monthly health insurance bill by 1.5% of your household income.

- The applicable percentage is the portion of a subsidy-eligible household's income that can be spent on the marketplace's benchmark plan (second lowest-cost Silver plan).

To apply for a qualified health plan, login to your secure online account, or call our Customer Service Center at 1-855-899-9600.