This is the tax form which shows every month of the year when you and your family members had a qualified health plan (QHP) with Vermont Health Connect (VHC). It also reflects the premium costs, and any advance premium tax credits (APTC) you got. VHC sends you and the Internal Revenue Service Form 1095-A to report your health insurance for the tax year.

If you got too much APTC, you may have to pay some back. If you didn’t get enough APTC, you may get a bigger tax refund.

- How do I get my 1095-A?

- What should I do if my Form 1095‐A looks wrong?

- What if my coverage changed during the calendar year but my 1095‐A doesn’t show the change?

- What if I think I should have a Form 1095‐A but didn’t get one?

- What if I had other coverage, such as Medicaid, when the 1095‐A says I had a Qualified Health Plan during that time?

- I experienced a life change during the year but didn’t report it to VHC. Now that the year is over, what should I do?

- I have a financial hardship and need my Form 1095‐A corrected now! What can I do?

- Why can’t I correct Form 1095‐A myself?

- What if my address is wrong on Form 1095‐A but the other information is right?

- I was told I must pay back the APTC I used. What can I do?

- When will I get a corrected Form 1095‐A?

- NEW Why was my electronic return rejected?

- I don’t agree with the information on my Form 1095‐A, but VHC customer support said that I won’t get a corrected form. Can someone else help?

- What if the VOID box is checked on my Form 1095‐A?

How do I get my 1095-A?

Vermont Health Connect mails your form 1095-A in late January. Check to make sure we have your correct address.

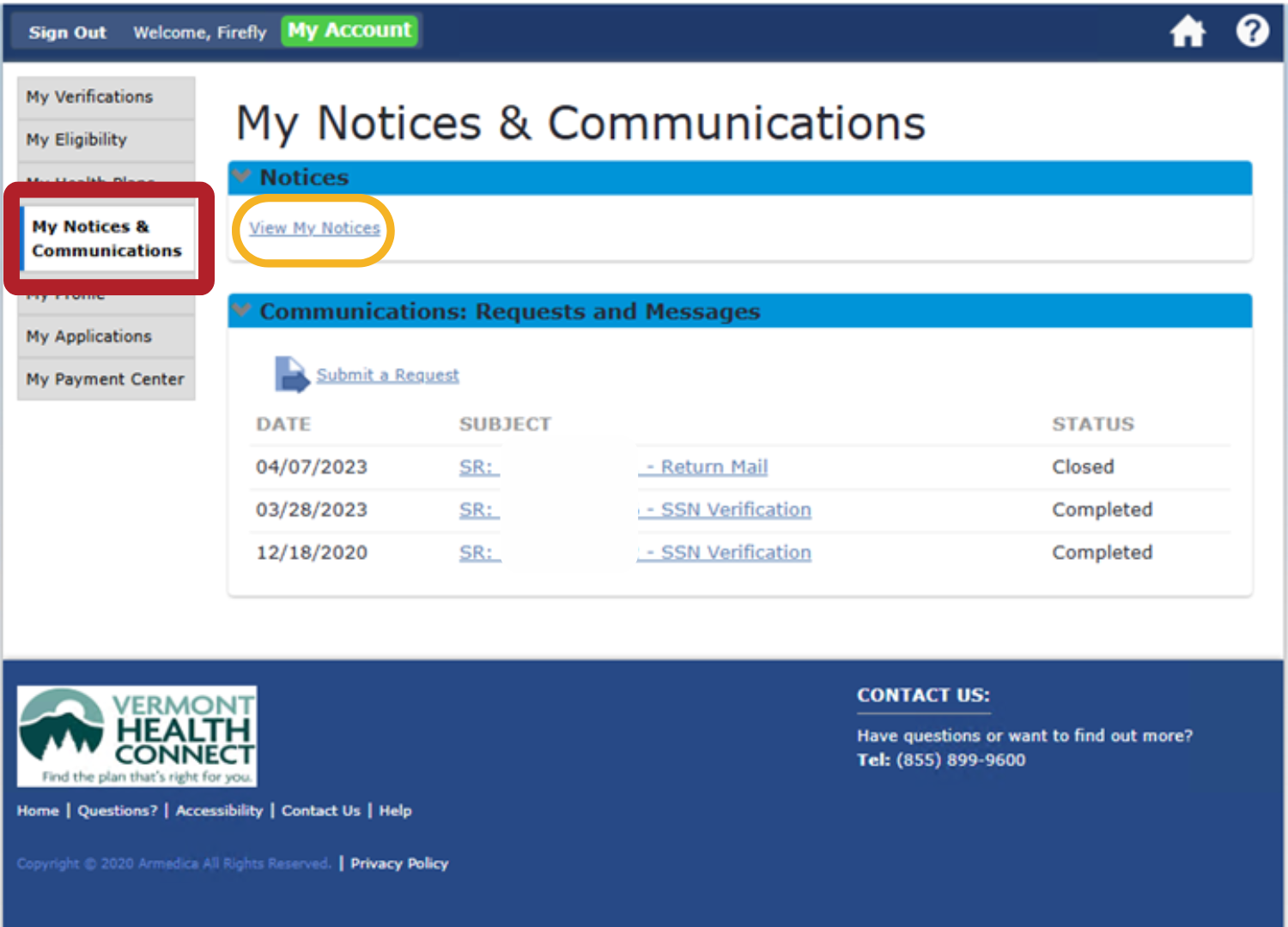

You can also view the 1095-A on your account. Once you have logged in, click the My Notices & Communications tab. Next, click the View My Notices link and a list of documents will appear. Your 1095-A should be listed there.

What should I do if my Form 1095‐A looks wrong?

Form 1095-A shows the coverage and advance premium tax credits (APTC) you got from Vermont Health Connect during the calendar year.

Please check your forms to make sure they show the information below:

- Dates your Qualified Health Plan (QHP) started and ended, and the dates you had other coverage.

- Household members covered.

- Correct monthly premiums for any plan(s) you or your family members had (shown in Part III, Column A of Form 1095-A.) The premium might be off by up to $5.00 due to Essential Health Benefits. If it is off by more than $5.00, please call Vermont Health Connect at 1-855-899-9600.

- Correct amount of APTC you got each month during the year (shown in Part III, Column C of Form 1095-A.)

If you disagree with the information on your Form 1095-A, please call Vermont Health Connect (VHC) at 1-855-899-9600 (toll‐free) and we will be happy to help you.

What if my coverage changed during the calendar year but my 1095‐A doesn’t show the change?

Vermont Health Connect will correct your Form 1095-A if you can show that your coverage changed during the year. Please call Vermont Health Connect at 1-855-899-9600.

If your QHP changes after you get your Form 1095-A, you will get a new form. Please look over the new Form 1095-A to be sure it is correct. You should use information from the new form to file your tax return. If you have already filed using wrong information, you can file an amended return. If you haven’t yet filed, you can file after you get the new Form 1095-A.

Vermont Health Connect sends Form 1095-A to both you and to the IRS. Some customers may get more than one updated form. If you are not sure whether you will receive an updated form, contact Vermont Health Connect. Your corrected Form 1095-A may not arrive right away. Wait a few weeks, then call Vermont Health Connect at 1-855-899-9600 to check.

What if I think I should have a Form 1095‐A but didn’t get one?

Contact Vermont Health Connect at 1-855-899-9600.

What if I had other coverage, such as Medicaid, when the 1095‐A says I had a Qualified Health Plan during that time?

Contact Vermont Health Connect at 1-855-899-9600. If there is an error, Vermont Health Connect will correct it and inform the IRS.

I experienced a life change during the year but didn’t report it to VHC. Now that the year is over, what should I do?

Life events include getting married, having a baby, becoming a U.S. citizen, adopting a child and other changes to your household size or income. Vermont Health Connect customers should report life changes within 30 days. By doing this, you will make sure you get the right amount of financial help and avoid owing money at tax time.

If you didn’t report the change during the calendar year, report it now to make sure you get the right amount of financial help next year. In most cases, you won’t need a new Form 1095-A to file your taxes— simply include the change on your federal tax return.

If you asked for a coverage change to the qualified health plan you got through Vermont Health Connect last year (for example, you ended your coverage, or added or dropped a family member) but Form 1095-A doesn’t show the change, contact Vermont Health Connect at 1-855-899-9600 to see if you need a new form.

I have a financial hardship and need my Form 1095‐A corrected now! What can I do?

If you have a financial hardship and can’t pay basic living expenses like rent, mortgage, car payments, car repairs, utility bills, childcare bills, food, or medical expenses, contact Vermont Health Connect at 1-855-899-9600 and explain your hardship. You may be able to get a corrected Form 1095 faster.

Why can’t I correct Form 1095‐A myself?

The information you file on your tax return needs to match the information the IRS gets from Vermont Health Connect. Vermont Health Connect reports APTC to the IRS, and VHC reports it to you in your Form 1095-A. The IRS may audit your tax return if the information doesn’t match the information they got from Vermont Health Connect, and the IRS may hold all or part of your tax refund until it is resolved.

What if my address is wrong on Form 1095‐A but the other information is right?

You can report changes like your address, number of household members and income when you file your taxes. You do not need a corrected Form 1095-A. Likewise, changes to your tax household such as divorce and income do not require a corrected form. However, you still need to report changes to Vermont Health Connect to get the right coverage and financial help in the following year.

I was told I must pay back the APTC I used. What can I do?

When you apply for a plan through Vermont Health Connect, we estimate how much APTC you can get based on the information you give us. When you file your next tax return, the IRS will use your actual income to find your final APTC amount. You can get too much APTC during the year if you make a mistake when you apply. You can also get too much APTC if you don’t report changes to your income or household size.

If you have questions, contact Vermont Health Connect at 1-855-899-9600. We will look at your case and answer your questions about APTC and APTC repayment. Learn more about APTC repayment.

Why was my electronic return rejected?

**NEW** Electronically filed tax returns will be rejected if the taxpayer is required to reconcile advance payments of the Premium tax credit (APTC) on Form 8962 but does not attach the form to the tax return. Read more about how to correct you tax return.

When will I get a corrected Form 1095‐A?

VHC will start sending corrected 1095-A forms in the spring. Look for the form with the checked “CORRECTED” box on the top of the Form 1095-A.

I don’t agree with the information on my Form 1095‐A, but VHC customer support said that I won’t get a corrected form. Can someone else help?

If you ask for a corrected form and Vermont Health Connect sends you a notice saying you don’t need a corrected 1095-A, you can start a process called reconsideration. During reconsideration a panel will review the case, and then DVHA’s Legal Division will send a written report of its decision and close the case. To ask for a reconsideration, call Vermont Health Connect at 1-855-899-9600 or use the Request for Reconsideration form within 30 days of receiving the notice. Fill out the form and mail it to: Vermont Health Connect, 280 State Drive, NOB1 South, Waterbury, Vermont, 05671-8100.

If you have concerns or questions about the decision, call the office of the Health Care Advocate at 1-800-917-7787.

What if the VOID box is checked on my Form 1095‐A?

If the VOID box on the top of your Form 1095-A is checked, this means you already got a 1095-A with information sent in error. When you file taxes, don’t use the information from a voided form, or the information from the first form you got that was wrong. Wait until you get the form with the checked “CORRECTED” box on the top of the Form 1095-A and use it to finish your tax return.