This is the tax form which shows the months you had Medicaid coverage. Vermont Health Connect and other government agencies use the Form 1095-B to show the months when you had minimum essential coverage (MEC) through Medicaid, Dr. Dynasaur, and/or Refugee Medical Assistance.

- Will I automatically receive a copy of my 1095-B?

- Will the IRS receive a copy of my 1095-B?

- Do I need the Form 1095‐B to file federal or state faxes?

- Do I need to file taxes if I have Medicaid?

- What if my Form 1095‐B shows Medicaid/Dr. Dynasaur coverage for different months than I thought I had it?

- I experienced a life change during the year but didn’t report it. Now that the calendar year is over, what should I do?

- Why can’t I correct the Form 1095‐B myself?

- Request a copy of my 1095‐B

Will I automatically receive a copy of my 1095-B?

No. As of tax year 2022, we will only send you a 1095-B if you request a copy. It will be mailed to the address that is on your portal account.

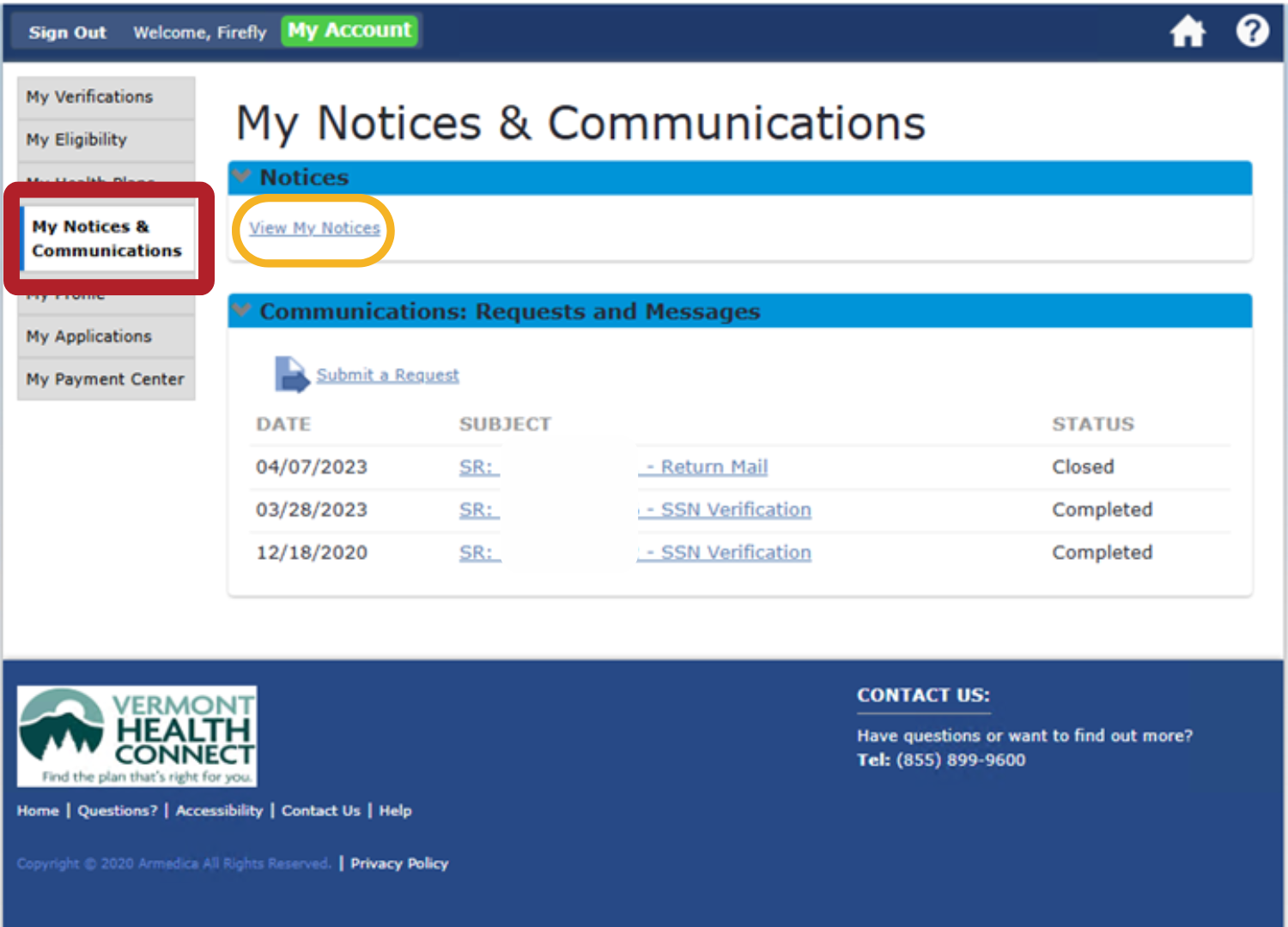

You can view the 1095-B on your account. Once you have logged in, click the My Notices & Communications tab. Next, click the View My Notices link and a list of documents will appear. Your 1095-B should be listed there.

Will the IRS receive a copy of my 1095-B?

Yes. We will send your 1095-B electronically to the IRS.

Do I need the Form 1095‐B to file federal or state faxes?

- Call - 1-855-899-9600

- E-mail - AHS.VTHealthConnect@vermont.gov

- Mail - Vermont Health Connect, Customer Service, Department of Vermont Health Access, 280 State Drive, NOB 1 South, Waterbury, VT 05671-8100

Do I need to file taxes if I have Medicaid?

The Internal Revenue Service can help you decide whether you must file a tax return. You can also visit vermont211.org or call 2-1-1 anywhere in Vermont. Vermont 211 can give you information about online help, people you can call, and people you can meet with to talk about whether you should file taxes.

What if my Form 1095‐B shows Medicaid/Dr. Dynasaur coverage for different months than I thought I had it?

If you requested a copy of your 1095-B and think the coverage months on your 1095-B are wrong, call Vermont Health Connect at 1-855-899-9600.

I experienced a life change during the year but didn’t report it. Now that the calendar year is over, what should I do?

Life events include getting married, having a baby, becoming a U.S. citizen, adopting a child and other changes to your household size or income. If you have Medicaid, Vermonters should report life changes to Vermont Health Connect within 10 days. That way, you will get the coverage that’s right for you and the right information for tax filing.

If you didn’t report the change during the year, report it now to make sure your coverage is correct for the following year. Changes to your last name, social security number, or date of birth will mean you need a corrected/new Form 1095-B.

Why can’t I correct the Form 1095‐B myself?

Form 1095-B is sent directly to the IRS from Vermont Health Connect. Please report any changes to Vermont Health Connect so we can update your 1095-B and send it to the IRS.

Who should I contact if I want to request a copy of my 1095‐B?

To request a copy, you can:

- Call - 1-855-899-9600

- E-mail - AHS.VTHealthConnect@vermont.gov

- Mail - Vermont Health Connect, Customer Service, Department of Vermont Health Access, 280 State Drive, NOB 1 South, Waterbury, VT 05671-8100